Have you recently received a letter about the assessed value of your home increasing as a result of the recent re-evaluation? Should you sell your house before it takes effect? Is your house worth more now than it was two weeks ago? Should you panic? Like all major life decisions, it’s best to approach them as logically as possible and try not to let emotions cloud your judgement. Let’s take a moment to go over what this re-evaluation really means so that you can make the best decision with a clear understanding!

Overall, everyone’s property value increased in this re-evaluation.

This means that our town mill rate, the other factor in determining your property taxes, will likely decrease. So, although your value may have increased, this doesn’t mean your property taxes will go up in direct proportion to this increase. Looking at the data as a whole, the larger the increase in this re-evaluation is indicative of the prior assessment being further from accurate. The prior valuations were inaccurate in many cases because it may have been decades since the assessor actually saw the inside of the home. Having more accurate data means that the property tax burden is more fairly distributed among the property owners.

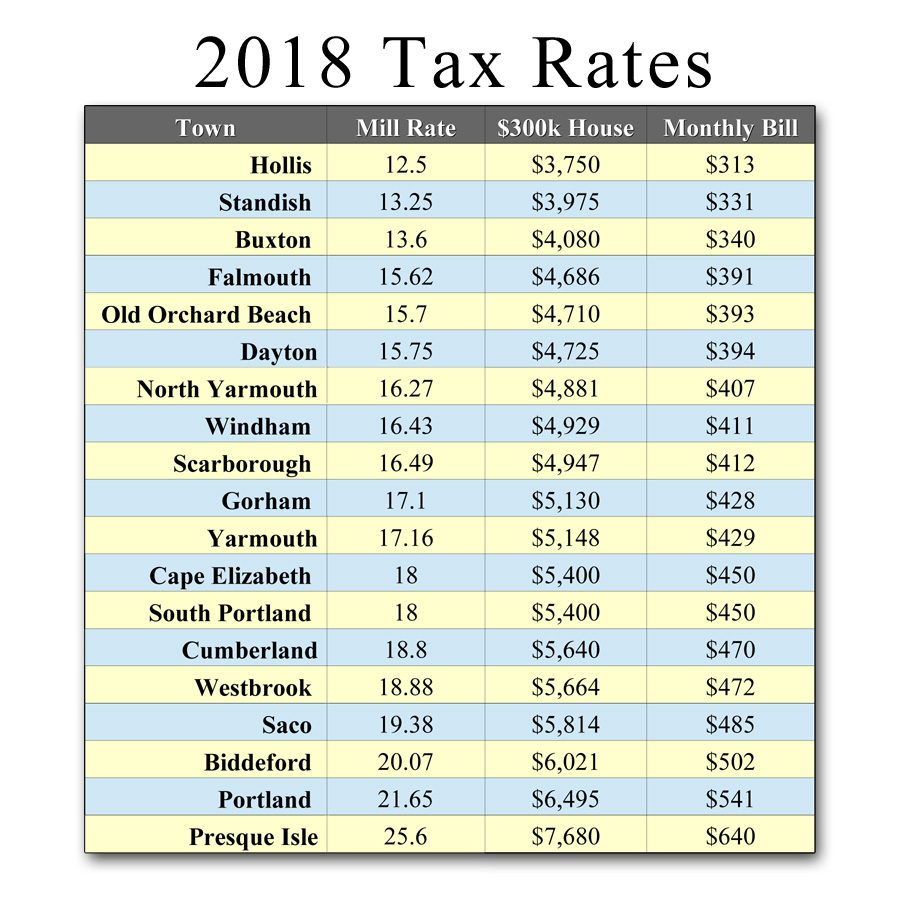

The way a town determines property tax valuations starts with the net budget expense, also known as the operating cost for the year. This is the total amount of money that will need to be collected through property taxes. They then take the total value of the real estate in the town and come up with a percentage to multiply value by to equal that operating cost figure. This is known as the mill rate. The current mill rate in Scarborough is 16.49 per thousand, or 1.649%, so a $300,000 house would have a tax bill of $4,947 per year.

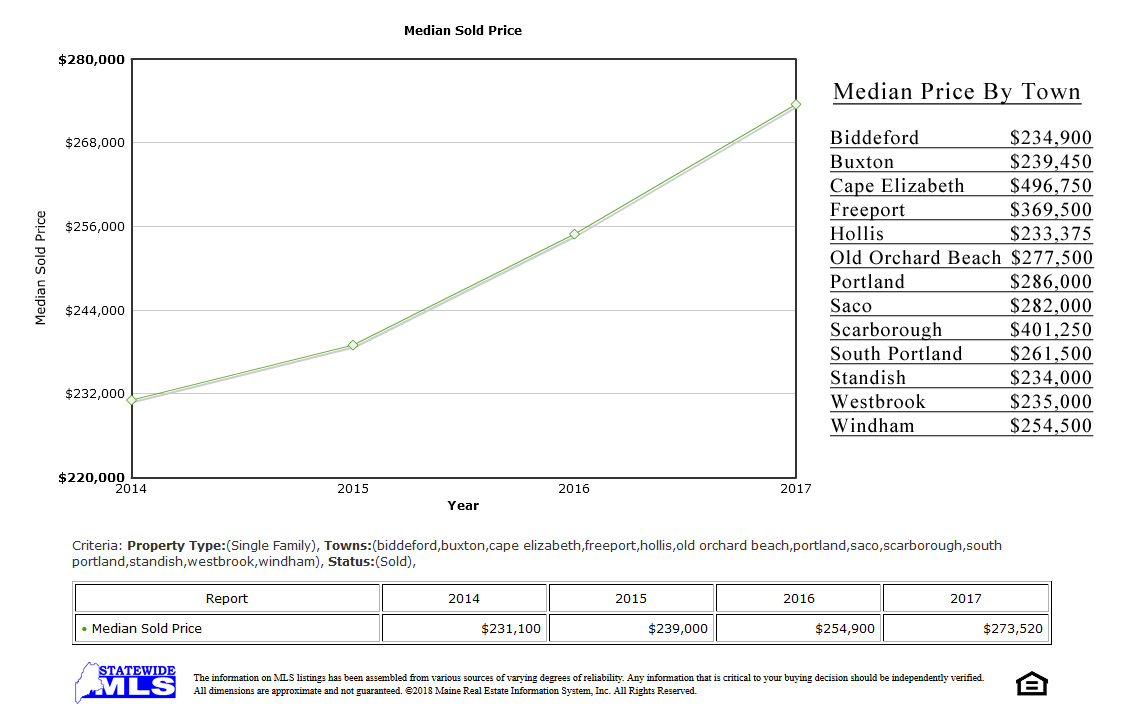

The new assessed value should be generally closer to your home’s actual market value.

However, the tax assessors goal is to try to distribute the tax burden as fairly as possible. Because of this, the data as a whole works, but on an individual level the value might not be accurate. There are also real world elements that affect market value that the standards used in an appraisal might not recognize. A house with 50ft of water frontage but no water views compared to a house right on the water with a sandy beach might be taxed equally.

So, should you sell your house?

It’s probably best not to react solely to this new re-evaluation. Perhaps downsizing makes sense for tax purposes and other reasons. Perhaps you’d be willing to move to a town that offers a lower tax rate and fewer services. Keep in mind however, that Scarborough is generally in the middle of the pack for tax rates. Neighboring towns are pretty comparable and many have higher tax rates.

Even if you aren’t sure if you want to sell now, contact the experts at The Real Estate Store for more information.

Want to keep updated on local real estate listings, stories, and tips? Follow us on Facebook or Instagram!

Short-term rentals are an up-and-coming way for travelers to stay in places that are not the conventional hotel or resort. For a generation looking for “authentic experiences,” it’s a fun and exciting market to tap into. However, there are many things to consider before you start your own short-term rental:

Short-term rentals are an up-and-coming way for travelers to stay in places that are not the conventional hotel or resort. For a generation looking for “authentic experiences,” it’s a fun and exciting market to tap into. However, there are many things to consider before you start your own short-term rental: